How To Make Your Salary Work For You

| Hi, “How?! When?? What did I even buy?!” Sound familiar to you? You’re certainly not alone. By default, a lot of us just want to spend, spend, spend right after getting paid and this kind of behaviour puts our finances in jeopardy. It’s time to fix it. ‘Money is for spending’. Sadly, some of us apply only this principle when it comes to our salaries. This kind of behaviour is what puts our finances in jeopardy. Instead of running from pillar to post, this is how you should plan your salary. |

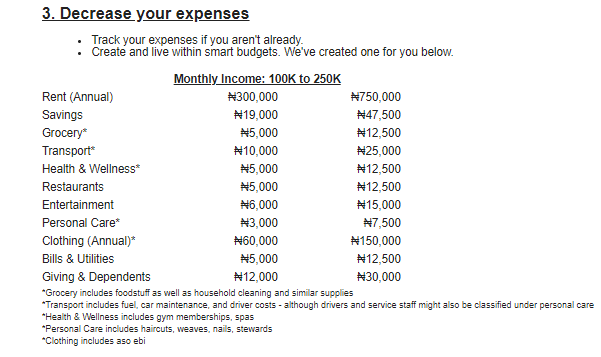

1. Calculate Your Essentials For The Month

Unless you want to keep being stranded every month, you should first calculate your basic needs like housing (though we don’t typically pay rent monthly, you should save up for it monthly), transport, electricity and feeding. Put aside no more than 50% of your total income for these expenses.

2. Put Something Towards Your Financial Future

Aim to put about 20% of your income towards savings, investments, education, health and insurance and other future plans. You should do this next, so that you can also grow your money or at least protect yourself with it…

3. Enjoy Yourself With The Rest

If you even have anything left, then the remaining 30% of your income can go to discretionary things like entertainment, clothing, small travelling, restaurants, data, personal care and giving. After all, we didn’t come to this life to suffer.

Personalized Financial Plan

We asked a finance guru for help with an actual financial plan based on our incomes and she prepared something for us. This is mine. If you add up my rent, transport, bills & utilities, grocery and restaurants(feeding), you’ll see that it all adds up to 50%.

No matter your financial circumstances, you can still have a beautiful life. The first 25 of you will receive insights from her to help you make the most of your money. Just answer a few questions to craft your very own personalized financial plan. Fill this form to get started.